TOX is an encrypted chat system, used it to talk with roach partners, I would vouch

> 10k per trade, I do a few trades a day.Sounds reasonable.

> Always.

> I only buy options which means my downside is only as large as my purchasing price.

> I only trade what I can afford to lose, and this is basically my back stop.

> Having said this those rare crashes such as black Monday where you essentially have nothing but a red candle hardly effect me regardless because my strategy is built on high liquidity. Such crashes are only an issue who have longer term positions.

> Even in major crashes like we saw recently the markets on the daily behave approximately the same, the only difference is a more aggressive mean drift which is very tolerable under my trading style given my strategy is built on volatility.Fair enough.

> Well the standard risk profile would have them categorized as speculations.

> That profile is heavily shaped by your strategy and the nature of your trades

> You can trade stocks as if you're gambling and you can bring options trading below the level of speculation while still maximizing returns my managing the risk profile.

> Most people trade options in a manner in which they decide the stock X will be value Y by the end of Z where Z is some expiration date of the option. Given they think A will be valued at B by C they will make their strike price S approximately Y to capture the most gain from the the move to Y.

> They have a chance at insane returns, I see people pulling off 50k off 10k trades over a week when correct. However I see more people lose 90% of their trade and the reason for this is that they are speculating on an event with low probability. As such their risk profile is really quite insane.I see how this happenes in principle, the part that confuses me is how one can make it work in practice. I'll need to get to know some of the fundamentals first and then build from there. Hopefully, things'll clarify once I get the gist of the basics.

If I were to draw an analogy, I can see a chess board, and I can see people making fancy winning moves, but I don't understand the rules of the chess. So even if someone tells me about a fancy way to win, I can copy it, but I won't understand why it works -- which is what I see as the biggest issue right now. I need a few fundamental building blocks that I can trust. I'm not looking for big returns, I'm approaching this as a potentially fun hobby, for now.

If you really want context I suggest you read Options and Volatility by Natenberg, it's essentially the Derivatives Bible.

> My trading thesis is: Underlying A has an average daily mean B and the probability of a mean reversion is C at variance D.

> I trade on highly probable events that take place every single day multiple times a day and I make my strike price the value at D and as such my lost rate is linear instead of parabolic.

> That's just how I trade and options can be complex, I know guys who trade options long term with the same risk profile as me but their style isn't my thing and mine isn't theirs. I believe in active trading because I believe in high liquidity as another back stop to my risk profile while they don't - it's an opportunity cost.Alright.

> What do you think Turncoat?

> He does seem fishy given he wants me to join a sketchy TOX server for 'privacy'.https://tox.chat/

By privacy, I meant `security.`

Tox is not sketchy, although I can see how it might be seen that way without the appropriate context/familiarity with the software. If anything, Discord is sketchy. Tox is open source, so it's open for review by anyone. Discord isn't. Any backdoors or security issues within Discord will be hidden away. Closed-source projects tend to have much more security flaws than their open-source counterparts. Having said that, tox has less features, because they want to build everything to be reliable and test it properly, whereas Discord wants to make a profit. I've spoken against use of Discord on several occasions here, saying we should switch to something else.

I found tox via this wiki page: https://www.whonix.org/wiki/VoIP#Tox

The software listed on that site are the VC options available to me, if I want to use tor (which I have since the beginning of visiting SC in 2010).

The other possibility was Mumble, which is also secure, but the issue is that apparently I can't host it with whonix for anyone outside of the tor network. I tried that out already. Which leaves me with either Tox or some other magic software that I am not aware of. Discord won't allow me to connect to it via a tor relay -- they want a handle on people's personal data (including geodata) in order to use their services. I'm not going to support that.

If you want more resources to convince you that Tox is reliable, and not sketchy, I can dig up some more. Alternatively, we can also just chat here. I suggested VC because I thought it might be easier to discuss via voice chat to avoid too much back-and-forth (I find it easier to discuss stuff like this via VC). Anyway, up to you. If you want Turncoat to confirm it's me, that's fine too, I don't think it's hard to prove it.

My last private chat with Turncoat was about my work, and I was complaining that I'm getting burnt out. I'm sure he can verify. My last private chat with you was on religion (but you already publicly acknowledged that). My last private chat with SpatialMind was about that girl who had some sketchy work @ Canadian politics, and some minor stocks discussion.

Okay, I get you.

The book is very helpful. I think I got the gist of a few concepts now, and I think I get why you're so interested in mean reversion.

I'm still trying to understand some of the fundamentals. For example, I don't understand what sets the pricing or why it should necessarily follow micro-level fluctuations in the stock price, unless the option is mostly intrinsically valued.

I made a quick mock-data stochastic stock price curve with an example `call` option. It just demonstrates how small fluctuations in the stock price can completely reshape the intrinsic value of a call option. The top panel is the `mock` stock price with a strike price at 58 USD. The two bottom panels give the intrinsic value in USD and % gain relative to the option price (300 USD premium). The percentage increase in the call option value is pretty high.

So that explains why, if you believe the stock price goes up, it's good to buy a call option. Or if there's a mean reversion (upward trend becomes a downward trend or vice versa), it makes sense to switch from a call option (I bet the curve goes up) to put option (I bet the curve goes down), or vice versa.

However, it assumes that the call option price will instantaneously adjust to the price of the stock. I can understand how, if the call option was only made up of intrinsic value, that will happen. Because the intrinsic value changes instantaneously. The call option would have a specific intrinsic value, and the fluctuation in that is what sets the option value.However, the call option can also have extrinsic (speculative) value, which is not necessarily, but can be, tied to its intrinsic value.

If the extrinsic value made up most of the value of the option, then I would imagine that it's up to whoever is making those speculations to decide how much they want to place value to micro-events.

That is, they could be simply valuing the stock or the option based on long-term performance, ignoring the micro-transactions. However, seemingly, that's not the case, and I don't understand why. Market bots + algorithm BS? Or otherwise the value of most options being traded is chiefly intrinsic?

Ps. This is pretty insane. Day trading, seemingly, is nothing but betting on whether the stock goes up (call option) or down (put option). It's horse racing, but replacing the horses with a stock curve. The fact that society is willing to pay billions to people who, seemingly, do nothing to contribute to the society, but instead work on models to determine if some curve goes up or down is, well. That's some next-level capitalism.

The book is very helpful. I think I got the gist of a few concepts now, and I think I get why you're so interested in mean reversion.

I'm still trying to understand some of the fundamentals. For example, I don't understand what sets the pricing or why it should necessarily follow micro-level fluctuations in the stock price, unless the option is mostly intrinsically valued.

I made a quick mock-data stochastic stock price curve with an example `call` option. It just demonstrates how small fluctuations in the stock price can completely reshape the intrinsic value of a call option. The top panel is the `mock` stock price with a strike price at 58 USD. The two bottom panels give the intrinsic value in USD and % gain relative to the option price (300 USD premium). The percentage increase in the call option value is pretty high.

So that explains why, if you believe the stock price goes up, it's good to buy a call option. Or if there's a mean reversion (upward trend becomes a downward trend or vice versa), it makes sense to switch from a call option (I bet the curve goes up) to put option (I bet the curve goes down), or vice versa.

However, it assumes that the call option price will instantaneously adjust to the price of the stock. I can understand how, if the call option was only made up of intrinsic value, that will happen. Because the intrinsic value changes instantaneously. The call option would have a specific intrinsic value, and the fluctuation in that is what sets the option value.However, the call option can also have extrinsic (speculative) value, which is not necessarily, but can be, tied to its intrinsic value.

If the extrinsic value made up most of the value of the option, then I would imagine that it's up to whoever is making those speculations to decide how much they want to place value to micro-events.

That is, they could be simply valuing the stock or the option based on long-term performance, ignoring the micro-transactions. However, seemingly, that's not the case, and I don't understand why. Market bots + algorithm BS? Or otherwise the value of most options being traded is chiefly intrinsic?

Yes, you are getting it perfectly.

Hopefully I can clear a few things up if you haven't figured them out yet.

When you are buying and selling options contracts you are buying and selling the premium of the contract which is the contracts value - we can call that total value of the contract. That premium is made up of intrinsic value and extrinsic value.

The intrinsic value, as you seem to know given your observations, is the difference between strike price and underlying price. If the underlying value is greater then the strike price than the options premium has intrinsic value, while if the underlying value is less than the strike price the intrinsic value will be 0 hence the premiums intrinsic value will be $0. In such a case the premium value only has extrinsic value.

So concerning your question related to if intrinsic or extrinsic value make up the majority value of the premium, the answer is that it depends. Given this reality, choosing strike price can be tricky because we can cheaper premiums on contracts that are said to be 'out of the money' meaning they have no intrinsic value but those contracts are often riskier. Do I buy a in-the-money(ITM) contract which will cost me more but is inherently less risky or do I buy an out-of-the-money(OTM) contract which is cheaper but riskier.

Extrinsic value is greatest at-the-money(ATM), meaning at the strike price, and as such if you buy, lets say, OTM calls then as you the value converges towards the strike price the contracts premium value will only increase based on variables that determine extrinsic value. From this you can infer that an options premium can gain value from this convergence and as such you'll make money off that premium even if it never reaches strike price. Hence, in the OTM example you have a premium of a contract completely dominated by extrinsic value.

In the inverse where we are dealing with ITM calls the value will be dominated by intrinsic value because as a underlying diverges from the strike price, in this case above the strike price, extrinsic value decrease. As I said extrinsic value is greatest at the strike price.

To understand this fully I suggest you study the variables that determine the intrinsic and extrinsic value, in finance they are called the Greeks: https://en.wikipedia.org/wiki/Greeks_(finance)

Ps. This is pretty insane. Day trading, seemingly, is nothing but betting on whether the stock goes up (call option) or down (put option). It's horse racing, but replacing the horses with a stock curve. The fact that society is willing to pay billions to people who, seemingly, do nothing to contribute to the society, but instead work on models to determine if some curve goes up or down is, well. That's some next-level capitalism.

It is beyond insane.

Hong Kong, Shanghai, Singapore, New York, Chicago, London - the worlds most major cities are completely dominated by this abstract means of 'creating' wealth.

Essentially, the worlds economy is primarily dominated by the trading of abstractions and their value is based on the value of other abstractions etc.

Options and futures whos underlying are stock value or Commodity are pretty low on the abstraction chain. There are compound options whos underlying is another option and this continues on and on up the chain.

This is fundamentally what caused the 2008 financial crises. The situation got so out of control because you had value of synthetic trades based on other synthetic trades, based on more synthetic trades, which are finally based on the value of some tangible asset. The majority of the value on books in the CDO market was essentially abstract and nontangible, as such when the tangible went belly up the abstract value became insolvent because of a massive mean reversion.

Thanks, Alice. Your explanation was very useful.

I'm currently reading up on the Black-Scholes formula as an example pricing model, and I'm in Chapter 6 of that book you gave me. So I guess the value depends on the type of option. So whether it's in, out, or at the money. I got those concepts a while ago by watching this introductory youtube video.

However, what I didn't still understand is more specific to that trick you're using, mean reversion. Let me know if I've understood correctly what you're doing. You take a O(minute) trade interval for a stock, and graph its price. In that interval, the mean O(millisecond-second) price fluctuates as usual.

Then, you attempt to find out the future local peaks and lows, so that you can purchase a put/sell a call at the peaks (betting the graph will go down) and purchase a call/sell a put at the lows (betting the graph will go up). However, in order for this tactic to work and for you to gain money from the increase in the intrinsic value, I suppose that the option you're buying should be valued chiefly intrinsically or close to the strike price (either at-the-money or in-the-money). Otherwise, I could see the extrinsic valuation being set by O(>~hour) fluctuations. Then the value of the option wouldn't change due to those underlying stock price fluctuations on O(second-minute) scale.

So, maybe my question is: How do you determine what type of option to purchase? Does it need to be valued mainly intrinsically for your trick to work, as it seemingly does? Or are you using the expected minute-scale fluctuations to determine the option's strike price? I'm asking more to understand the top-level logic, because it's not clear to me under what situations the option pricing correlates with the underlying stock price the most (or if it is expected to always correlate with it strongly, which seemingly doesn't need to be the case).

On the crash/finance economies: I'm betting we'll go back to stone ages, trading squirrel skins and stuff if this keeps up. They'll keep inventing stuff until eventually shit hits the fan.

Thanks, Alice.

I'm currently reading up on the Black-Scholes formula as an example pricing model, and I'm in Chapter 6 of that book you gave me. So I guess the value depends on the type of option. So whether it's in, out, or at the money. I got those concepts a while ago by watching this introductory youtube video.

Look into Longstaff-Schwartz next.

However, what I didn't still understand is more specific to that trick you're using, mean reversion. Let me know if I've understood correctly what you're doing. You take a O(minute) trade interval for a stock, and graph its price. In that interval, the mean O(ms-s) price fluctuates as usual.

Then, you attempt to find out the future local peaks and lows, so that you can purchase a put/sell a call at the peaks (betting the graph will go down) and purchase a call/sell a put at the lows (betting the graph will go up). However, in order for this tactic to work and for you to gain money from the increase in the intrinsic value, I suppose that the option you're buying should be valued chiefly intrinsically (either at-the-money or in-the-money).

That is, I could see the extrinsic valuation being set by O(>~hour) fluctuations.

So, maybe my question is: How do you determine what type of option to purchase? Does it need to be valued mainly intrinsically for your trick to work, as it seemingly does to me? Or are you using the expected minute-scale fluctuations to determine the option's strike price? I'm asking more to understand the top-level logic, because it's not clear to me under what situations the option pricing correlates with the underlying stock price the most (or if it is expected to always correlate with it strongly, which seemingly doesn't need to be the case).

Yes, the majority of the value I gain is intrinsic. I am trading in short intervals, each trade lasting about an hour at most. As such the extrinsic value, which is time sensitive, is unlikely to change much.

The strike price I chose is mainly determined by my certainty of mean reversion. If I am highly certain I will buy at the money so that I can obtain the most intrinsic value from the trade possible. If I am uncertain, in this usually relates to my timing and not the reversion itself, I will buy in the money so I have cushion on the downside.

On the crash/finance economies: I'm betting we'll go back to stone ages, trading squirrel skins and stuff if this keeps up. They'll keep inventing stuff until eventually shit hits the fan.

Pretty much, just look at the defi space in crypto.

Those 'assets' are fucking insane.

It's been a while and my head hurts

but...

Time to take a break from all this reading, enjoy applying what I've learned, and take some time to attend to family.

What you said clears things up; so I guess that fundamentally it's that the derived value comes from the intrinsic fluctuations, and you probably have some model to determine both the probability of the mean reversion and the probability distribution of the peak/low at the opposite end (the next minima/maxima). I'll look into volatility some more first before really diving into the details of the Black-Scholes (or Longstaff-Schwartz) model after all. The first chapter on volatility in that Natenberg book was a bit underwhelming.

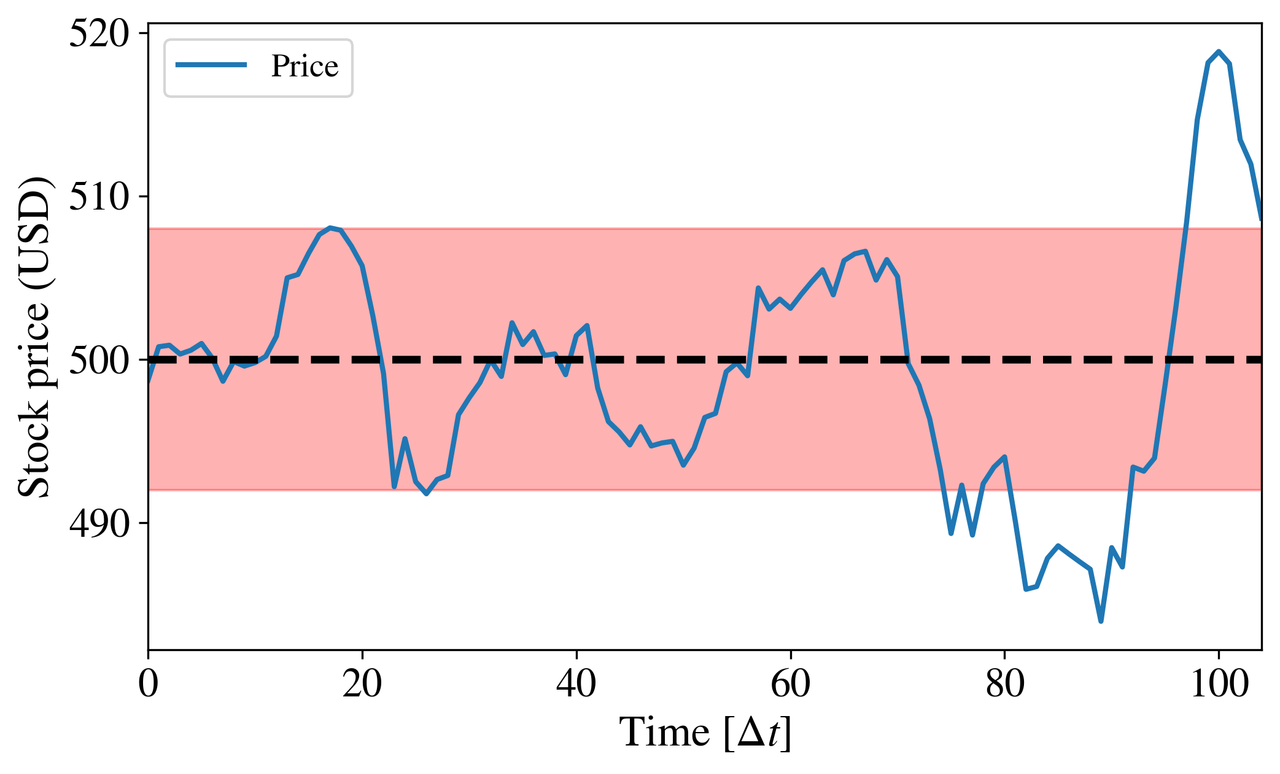

I'm trying to build a qualitative understanding of the effect of the bid-ask distribution on the stock price. Stock price curve modelled through a constant fair price distribution (500+-8 USD normal) and an evolving bid-ask distribution. The steps follow mostly random walk as a consequence of the changing (Poissonian) influx of traders but the fair price model forces the model to go through mean reversions in the long term.

(work in progress)

Once I've worked this out, I'll go through more content on the stochastic processes in stock price modelling. However, I was somewhat disappointed that most texts discussing these random processes don't build upon any foundation. Rather, it's generally stated that, empirically, the stock curves exhibit stochastic behavior. Yet, without further elaboration, the claim is as random as the process itself.

In the above model, I'm including the stochasticity through the change in the number of traders (I think it's easier to accept that the influx of people will change stochastically over time, given no change to the market environment, than that the curves themselves simply happen to be random -- I'm sure other processes also play a role here besides influx of people, but it's a starting point).

The efficient market hypothesis, which Alice kindly pointed me to, explains things slightly better, but the underlying assumptions tend not to capture many of the realistic market behavior (e.g., mean reversions, as far as I understand).

One interesting feature that I got out of this model, which I did not expect, is that if there's a sudden surge in either demand or supply, there is an almost immediate, even more rapid surge in the opposite (from demand to supply or from supply to demand) that forces the price all the way to the opposite end of the curve. Not sure if it's a real effect or an artificial feature of the model.

Anyway, there are several things still missing. The bid-ask dynamic isn't quite realistic, I havent tested these with real market data, and the fair price should evolve. In due time :)